Exchanges of Assets for Assets Have What Effect on Equity

And now what is the actual. Ultimately the accounting equation is balancing total assets with the sum equity and liability equity being a positive and liabilities being a negative.

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

Balance Sheet Definition Formula Examples

The following instruments are traded on the equity capital market.

. Anything on the balance sheet affects a companys equity as any movement in assets and any movement in liabilities changes equity unless the two move in lockstep. Exchanges of assets for assets have what effect on equity. May have no impact on equity C.

First of all I will brought a dragon for you so that you will be able to understand it. Thus the value of the companys current assets and business define the value of its equity capital. There is no relationship between assets and equity.

Business Accounting Principles of Accounting Volume 1 Exchanges of assets for assets have what effect on equity. Equity refers to the owners value in an asset or group of assets. Equities commodities and debts are the three kinds of assets that a person can hold.

What is the Asset to Equity Ratio. So what will be the owners equity. No the portion is asking those What will be the effect off issuing stocks.

So it will Porto a company. Equity 30000 in stock you and Anne Notice how your companys total assets have increased by 10000 and your liabilities have also increased by 10000. There is deemed to be a culmination of the earnings process when assets are exchanged.

Increases in assets and decreases in liabilities raise. Common stock shares represent ownership capital and holders of common. Okay were chart off firms as off.

In other words one productive component is liquidated and another is. Liabilities are financial obligations including things such as. There is no relationship between assets and equity.

Libraries are still 500 from the previous example. Asset classes are about economic substance not form. Exchanges of assets for assets have what effect on equity.

Equity is assets minus liabilities or value minus debt. The asset to equity ratio reveals the proportion of an entitys assets that has been funded by shareholders. The fair value approach for exchanges having commercial substance will ordinarily result in recognition of a gain or loss because the fair value will typically differ from the recorded book value of a swapped asset.

If I stuff my mattress with cash USD I am holding a monetary asset. O Withdrawals Increase Exchanges of assets for assets have what effect on from MATH 1119 at Arellano University Pasay. Interest and dividends payable.

There is no relationship between assets and equity. Revenues losses expenses and gains b. Exchanges of assets for assets have what effect on equityA.

May have no impact on equity. Unlike example 1 where we paid for an increase in the companys assets with equity here weve paid for it. So our portions is that it will not make any difference Toe owners equity if there will be an exchange office set for and Asset Okay No we have understood the Pont equation and the effect off exchange office.

Assets liabilities and owners equity. There is no relationship between assets and equity. When youre looking at a balance sheet the stockholders equity commonly referred to as the shareholders equity section reflects the difference between.

In a company equity belongs to the owners which for publicly traded companies means the shareholders. May have no impact on equity d. 10 LO 22 Exchanges of assets for assets have what effect on equity A increase from ACCT 101 at Pierce College.

Short-term Treasury Bills really behave more like a monetary asset than a. For example stocks stock options stock index futures stock index ETFs and stock mutual funds all belong to the equities asset class because all represent equity exposure ownership stake in one or more companies. According to Shanghai United Assets and Equity Exchanges announcement Michelin is the transferee of the 30 shares of Shanghai Michelin Warrior Tire Co.

The inverse of this ratio shows the proportion of assets that has been funded with debt. Equity is also referred to as net worth or capital and. If I hold the stock of an individual company then I have an equity asset.

Matters like to suppose we have extent company okay Willing toe start new loading business. September 5 2020 Leave a comment. Identify the correct components of the income statement.

For example a company has 1000000 of assets and 100000 of equity which means that only 10 of the assets have been funded with. It foreign asset on the owners equity. Just like homeowners accumulate equity value as they pay off their mortgage Owners Equity is defined as the proportion of the total value of a companys assets that can be claimed by its owners whether a sole proprietorship or a partnership.

Different Instruments Same Asset Class. May have no impact on equityC. I forgot one other kind of asset.

Exchanges of assets for assets have what effect on equity. There is no relationship between assets and equity b. Issuing capital between stocks in exchange for escorts.

Equity capital is raised by selling a part of a claimright to a companys assets in exchange for money.

How Is Cross Chain Defi Achieved On Horizon Protocol 04 Cross Chain Horizons Volatility Index

Differences Between Assets And Liabilities Liability Asset Intangible Asset

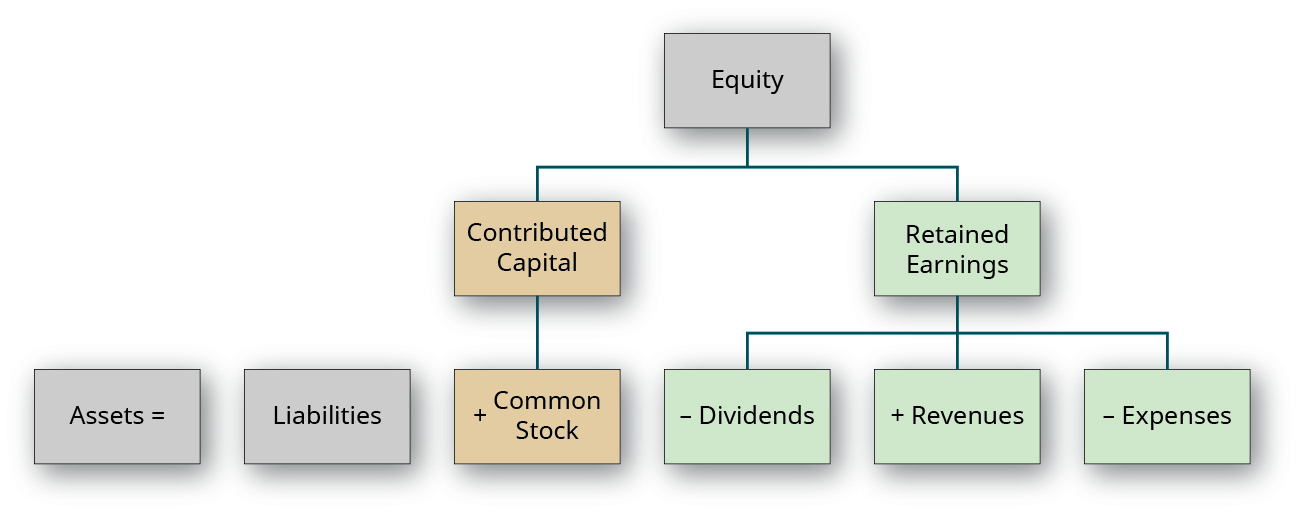

Define And Describe The Expanded Accounting Equation And Its Relationship To Analyzing Transactions Principles Of Accounting Volume 1 Financial Accounting

A Financial Market Is The System Through Which Financial Assets Are Negotiated It S Made By Exchanges B Financial Markets Financial Instrument Financial Asset

Advantages And Disadvantages Of Leasing Lease Accounting Basics Financial Strategies

Accounting 131002 Final Exam Paper With Covering Majority Of The Exam Studocu Exam Papers Accounting Exam Learn Accounting

Liquid Assets Learn Accounting Accounting Education Bookkeeping Business

The Report Released Recently By Prequin Shows How Institutional Investors Are Increasing Their Allocations To Alternative Private Equity Equity Infrastructure

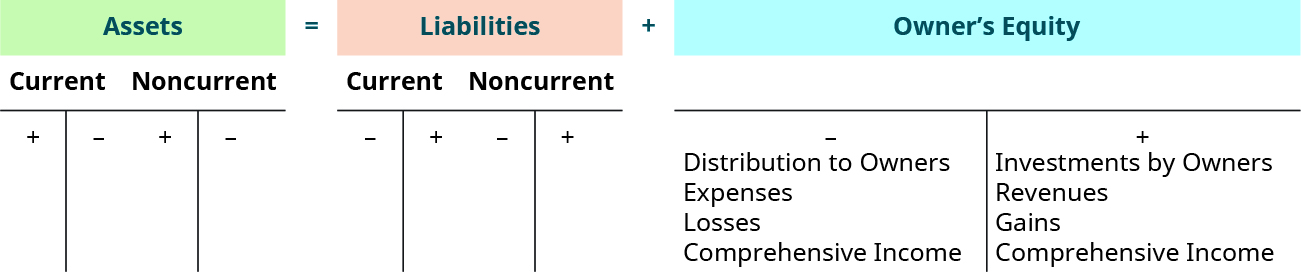

Define Explain And Provide Examples Of Current And Noncurrent Assets Current And Noncurrent Liabilities Equity Revenues And Expenses Principles Of Accounting Volume 1 Financial Accounting

We Put Shareholders Vs Stakeholders As Owners Vs Any Parties Interested In The Company Note T Accounting Education Accounting And Finance Learn Accounting

Pin By Raisa On C Economics Lessons Finance Investing Accounting And Finance

Ch01 Solution W Kieso Ifrs 1st Edi

Hedging Vs Speculation All You Need To Know In 2022 Investing Risk Management Futures Contract

Still Unaware Of The Benefits Of Cryptocurrency Exchange Cryptocurrency Blockchain Technology Crypto Coin

Important Basic Financial Terms Every Newbie Must Know Fintrakk Financial Quotes Financial Life Hacks Finance Investing

Introduction To Definition Stages Of Private Equity And Venture Capital And How Are They Different Privateequ Startup Funding Venture Capital Startup Design

/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg)

Comments

Post a Comment